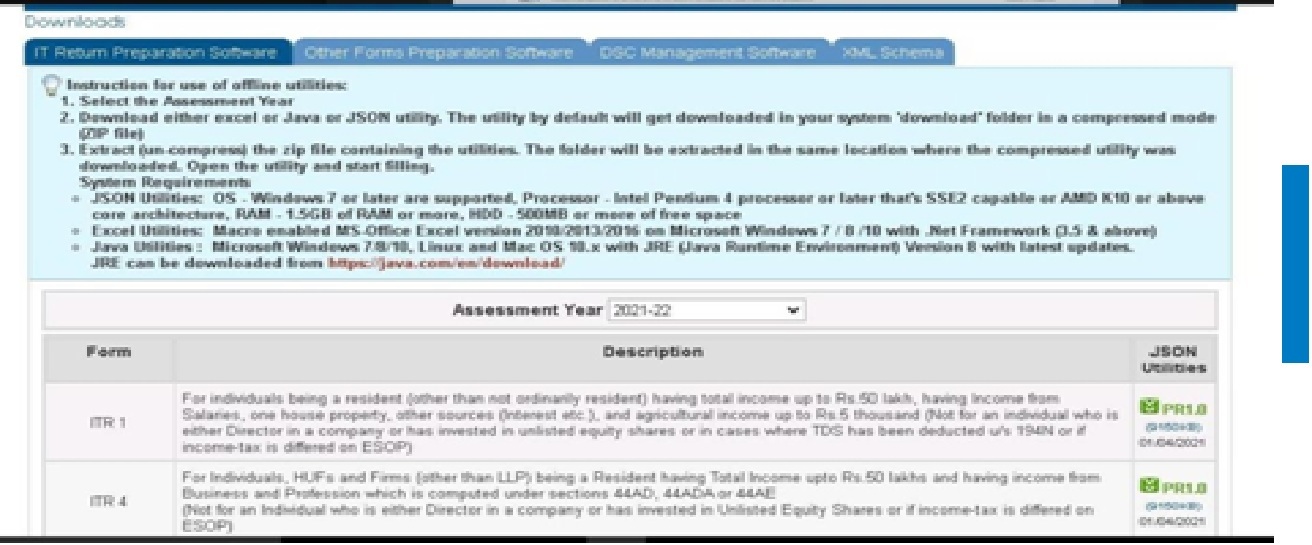

This means that the information entered by the user is not matching with his PAN card, while everything is being entered correctly. Problems with PAN CardĪnother problem is that, whenever a user is trying to validate any of his information by visiting the new Income Tax website, he is seeing a data mismatch error. That is, you have to face all the problems regarding the password. Even if this option works, then there is a problem in getting the OTP. But if you want to change the password, then the forget password option is not working. Sometimes the website is also notified that the password is wrong. Whenever a user is trying to log in to the new website of Income Tax, they face the problem of login failure multiple times. However, there are refund issues still on the portal and taxpayers and clients are reaching to authorities for a better solution. Note: Recently the analysts and researchers have found that all these problems are solved and these issues are below 60% with the recent updates. The Income Tax Department has introduced the Javascript Object Notation facility (JSON utility) for the assessment year 2022, but this facility is not visible on the website yet.It is also showing the under-processing of returns processed in March 2021.If I try to do ITR verification by selecting ‘self’ in the capacity, then the name disappears and showing a validation error.There is a problem in viewing the 26AS form, which is very important.Old Outstanding Demand is also not showing.ITR is not being filed for the financial year 2021, i.e.Filed ITR receipts are not being downloaded.ITRs for different financial years are not being downloaded in PDF format.Errors are circulating on the portal while filing income tax returns as several taxpayers are complaining via Twitter.They also said, there was no relief on interest for the late filers.ġ0 Problems Related to ITR People are Facing

The CBDT informed the Gujarat High court that the developer team has to fixed the several glitches faced by the taxpayers while uploading audit reports and filing returns on the new e-filing portal.The Department of income tax directed Infosys regarding the fresh technological problems from the income tax e-filing portal.

0 kommentar(er)

0 kommentar(er)